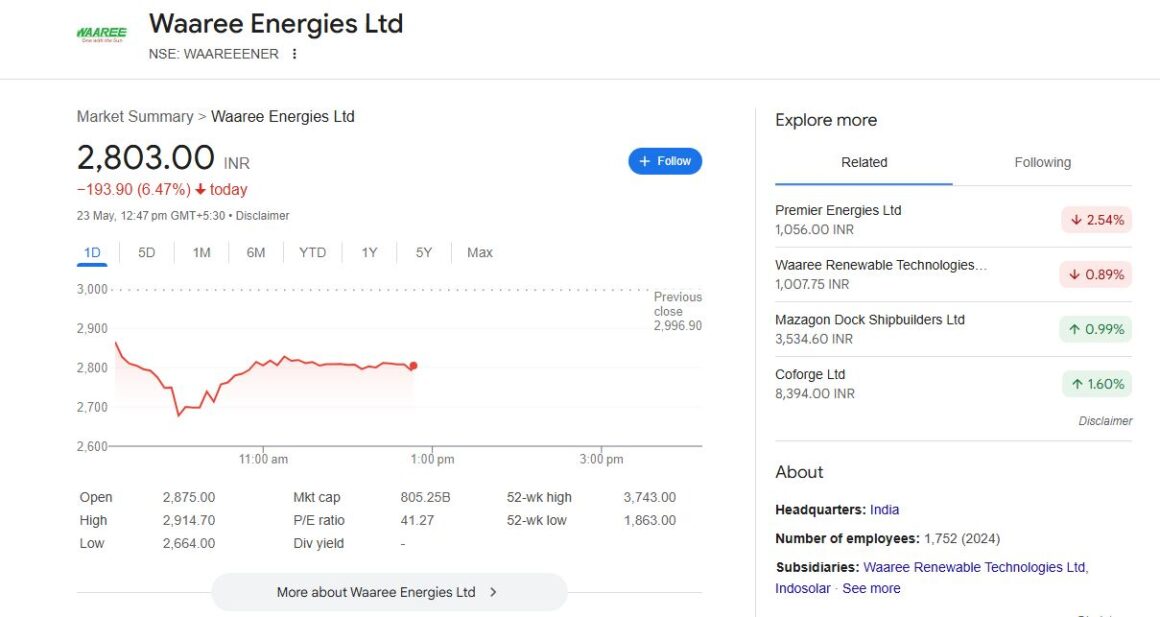

If you’ve been tracking the markets this week, you’ve likely noticed Waaree Energies stock making waves. As I write this, the counter is trading at ₹2,967.60 – up a staggering 21% in just the past month. My broker friend in Dalal Street jokes that even his tea-wallah is asking about Waaree these days.

What’s really interesting isn’t just the numbers (though we’ll get to those), but how this homegrown solar player has become a proxy for India’s clean energy ambitions. Remember when solar was just a niche sector? Waaree’s making it mainstream.

The Fuel Behind Waaree Energies Stock Rally

Three things are supercharging Waaree Energies stock right now:

- That Blockbuster Quarter

Last week’s results showed revenue jumping 36% to ₹47,000 crore. But here’s what really got investors excited – their order book now stretches into 2027. That’s visibility even IT giants would envy. - America’s Solar Gold Rush

With the U.S. shutting out Chinese solar imports, Waaree’s $1.2 billion U.S. expansion couldn’t have been better timed. Their Texas facility is running three shifts to meet demand from data centers going green. - The Modi Multiplier

Government tenders for solar parks are coming faster than monsoon showers. Waaree’s supplying panels for everything from railway stations to airport roofs.

Smart Money Moves

While retail investors chase the momentum, institutions are playing it smarter:

- Jefferies trimmed their position citing valuation concerns

- Nuvama just raised their price target by 18%

- FII holding crossed 12% last month

My neighbor Ramesh, who bought at ₹1,200, is grinning. But his CA just warned him about the 41 P/E ratio. “Solar isn’t IT,” he muttered.

Storm Clouds on the Horizon?

It’s not all sunshine:

- Adani’s new 10GW factory could flood the market

- That viral video showing defective panels in Rajasthan? Waaree claims it’s fake

- Steel prices are eating into margins

Should You Buy Waaree Energies Stock Now?

Here’s my take after chatting with three analysts and two solar contractors:

✅ Good for long-term believers in India’s solar story

❌ Avoid if you can’t handle 10% daily swings

💡 Watch for their June 15 investor meet on battery storage plans

Final Thought

Waaree Energies stock isn’t just a ticker – it’s become a litmus test for India’s renewable energy transition. As I finish this piece, the stock just ticked past ₹3,000. Something tells me this story’s just getting started.

*Data checked live at 2:45 PM IST.….

Leave a Reply